Hello and welcome to Topnews.co.ke. Before we begin, Please remember to accept the notification button that pops up on your gadget for subscription ,and share widely to help us inform ,educate and entertain masses.!

Safaricom is Kenya’s largest mobile provider, providing a variety of mobile lending services such as Fuliza, M-Shwari, and KCB M-Pesa.

Unfortunately, Muslims are unable to obtain loans through these items since they bear interest, which is contrary to Islamic teachings.

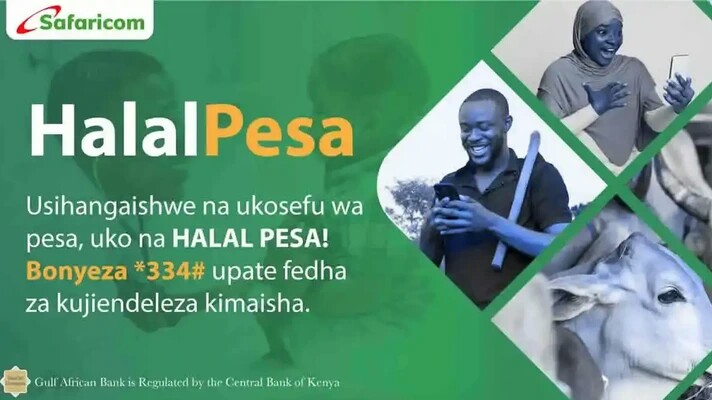

To address this issue, Safaricom collaborated with Gulf African Bank Ltd to offer Halal Pesa, a Shariah-compliant digital finance service that runs on the MPesa platform.

This article will teach you about Halal Pesa and how to register and borrow money from the service.

How to register

It is simple to join Halal Pesa. You only need a Safaricom line that has M-Pesa registered; you do not need to be a Muslim, as you may feel.

To register, dial *334# from your MPesa-registered line. Choose “Loans and Savings,” then “Halal Pesa,” and finally “Register.” Lastly, accept the terms and conditions and finish the registration process by entering your M-Pesa PIN.

Another option is to use the mobile app, which is accessible for both Android and Apple smartphones.

Install the app from the Google Play or App Store on your device. Choose “Grow” when you open it. Following that, the registration process is simple; simply follow the steps on your screen.

Wait for a confirmation message after completing the above steps.

Halal Pesa loan limit

You can borrow as little as Ksh 1,000. The upper limit for first-time clients is Ksh 15,000 and Ksh 20,000 for recurring customers.

You can extend your loan limit by using MPesa frequently and paying off your Fuliza, M-Shwari, and KCB MPesa loans.

Halal Pesa interest rate

There is no interest charged by the facility. It instead adheres to Sharia law, which forbids making money from money. It only charges a 5% margin, which is repaid after 30 days.

How to Pay Back a Halal Pesa Loan

You may repay your loan by following the steps outlined below:

Choose “Loans and Savings” by dialing *334#.

Choose “Halal Pesa” from the menu list. Choose “Facility” and then “Pay Facility.”

Complete the transaction by entering your M-Pesa PIN.

Conclusion

Halal Pesa is an excellent mobile financing option that allows Muslims to borrow “Halal Loans” and repay them after 30 days.

Even if you are not a Muslim, you can use this facility because it is a low-cost alternative to other mobile lenders such as Tala and M-Shwari.

To increase your limit, you must be prepared to return the whole amount plus the 5% profit on time.

Thank you for reading.